I am a Mexican who grew up in the “small” town of Guadalajara, Mexico (6M people, but feels small compared to Mexico City’s 20M+ population). I’ve had the privilege of studying and working in the LATAM, European and US markets, and calling world-class metropolises like Mexico City, Paris and New York my home. In 2016, following my heart, I reluctantly moved to Miami. Today, against all my expectations, I have fallen in love with this region and am ready to bet on its growth. And so is 500 Startups.

Curious? Skeptical? Stay with me.

As I wrote on the 500 Startups blog last March announcing the launch of 500 Startups Miami, this city and the larger Florida region is heating up and it’s not necessarily related to the beach or basketball. 500 Startups firmly believes that South Florida’s tech, innovation & entrepreneurial ecosystem is at an inflection point, with the real potential of becoming a global hub – and the best is yet to come.

Why? First, let’s take a look at where we are now and how we got here.

The evolution of an unassuming ecosystem

Entrepreneurial ecosystems typically develop in waves of systems/networks that continuously engage, cross-pollinate, create feedback loops, and strengthen themselves. The Kauffman Foundation and Endeavor have great research on this topic.

In the entrepreneurial world, these “waves” are made up of go-getters and hustlers who find a way to work together to build a bigger pie for all. These waves thrive with success stories that have the power to:

- Attract more attention, talent and capital to such ecosystems

- Inspire the new generation of successful startups and provide mentorship, funding, and access to networks.

And thus the virtuous cycle is reinforced on and on.

How has this played out for South Florida?

The Genesis in the 50s

The origins of the South Florida tech ecosystem today can be traced back to the 1950s, when the “first wave” of entrepreneurs were building life-changing technology for the world. Some examples you may not know about:

- In 1957, the maker of the first cardiac pacemaker and the first bare-metal heart stent in the US, Cordis, was founded in Miami.

- In 1961, the Coulter Corporation, that developed the method used to date to count blood cells, was established in Hialeah.

- In 1980, Manny Medina founded Terremark in Miami, which created of one of the largest data centers in the world, the NAP of the Americas.

- In 1981, IBM designed and assembled its first Personal Computer (IBM PC) in Boca Raton. Along the way, the beloved Ctrl + Alt + Del command was also developed.

The Renaissance in the 2000s

Miami has greatly evolved in the last 20 years. From a retirement community, to a market booming with real estate investing, to a city put on the global arts map thanks to Art Basel, the city is now positioning itself as the host of one of the most important entrepreneurial movements in the country.

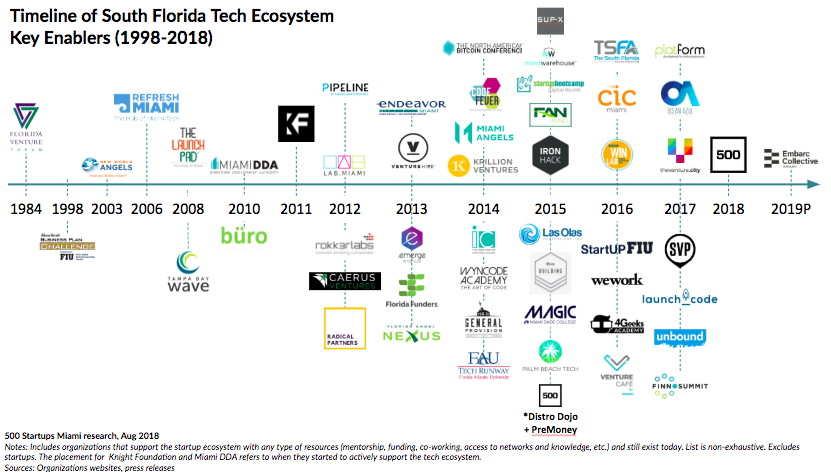

I believe that the overall development of the city, along with the foundations laid in the Genesis period, led the City to start in the early 2000s what I would like to call the Renaissance (See Figure 1 below.) In this period, a new generation of local players realized that they wanted to create more opportunities in the region they called their home and that South Florida had huge potential to become a fertile ground for innovation and entrepreneurship.

These homegrown efforts spearheaded by brave and visionary souls became the building blocks of the ecosystem that we know today. Early players include the tech community Refresh Miami, co-working space The Lab Miami, and accelerator Venture Hive. But a big part of these efforts were spurred and funded by organizations such as The Knight Foundation and Miami Downtown Development Authority, who realized early on the impact they could have on the city if they supported the growth of this ecosystem, and became key enablers of its success.

As you know, talent is a crucial piece of the puzzle. University of Miami, Florida International University and Miami Dade College all launched programs to promote startups and innovation. Wyncode and Iron Hack quickly realized that training highly qualified and technical talent would be indispensable to the sustained development of this ecosystem, and so they set out to establish their coding schools, together having graduated already +2,600 developers.

And so our startup household names were born. In 2004, Rony Abovitz and Maurice Ferre co-founded our first known unicorn, Mako Surgical, which was sold at $1.65B to Stryker in 2013. Remember the waves we were talking about? Abovitz went on to found Augmented Reality unicorn Magic Leap; and Ferre founded DermaSensor to facilitate detection of skin cancer.

Speaking of unicorns, Florida is home to at least five: Mako Surgical, Magic Leap, JetSmarter (now XO), chewy.com, and Fanatics.

Other beloved and established success cases in the region include CareCloud, Modernizing Medicine, E-Builder, Nearpod, Finova Financial, and Open English.

Finally, there are plenty of rising stars with the potential to make it huge. These include Plum, Boatsetter, BabySparks, VoyHoy, Blanket,, Home61, Clutch Prep, Whereby.us, Xendoo, Fanatiz, Option Alpha, Mediconecta, Daycation, Shoot My Travel, Caribu, Smart Barrel, among many, many others.

And although we lost Court Buddy to San Francisco and FIGS to Los Angeles, we imported Moocho from Los Angeles and Genius Plaza from New York.

Going back to the evolution of the ecosystem, do you want to hear about more amazing spillover effects? In 2014, Terremark’s founder Manny Medina launched eMerge Americas, the first tech-focused conference uniting Miami with LATAM. In 2015, a group of AGP (now Miami Angels) Angel Investors spun off to raise the Las Olas Venture Capital fund, and Florida Angel Nexus Angel Investors gathered to start the FAN Fund.

Once these early homegrown players started demonstrating early traction and impact, the world started looking more closely at South Florida. Suddenly, we had world-class organizations such as Endeavor, Startupbootcamp Digital Health, and the Cambridge Innovation Center launching local operations. World-class organizations, like The Venture City, are starting to be founded locally. After flirting with the region since 2012, 500 Startups officially launched a Miami operation in April of this year.

And it has been exciting to see that City of Miami’s new mayor Francis Suarez has made it a priority in his agenda to foster technology as “an economic driver for the city to remain competitive in the global marketplace.”

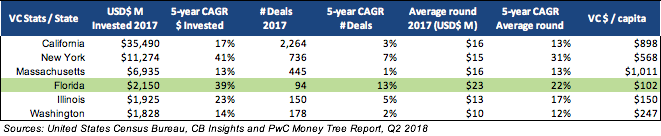

Finally, let’s talk about capital, the fuel on which startups grow. When I dive into the data, it looks very encouraging. Florida boasts one of the largest growth rates in the US both for VC dollars received and for size of rounds in the last 5 years. See more details in Figure 2 below.

So what’s next for South Florida?

I hope that by now you are building up the excitement for this region. In my opinion, what is next is, as my friend Elvis would say, “A little less conversation, a little more action.”

Recognize and lean into our natural assets

We will never become Silicon Valley, nor should we aim to. South Florida has its own DNA and will thrive only when it fully embodies and capitalizes on it.

- Connecting to LATAM and Europe: According to the Miami International Airport (MIA), MIA offers more flights to LATAM and the Caribbean than any other U.S. airport, and is America’s third-busiest airport for international passengers. To me, this translates as increased talent and goods mobility, and ease of doing business.

- Truly diverse pool of talent: According to the Miami Herald, 39% of professional workers in business, sciences, tech, education, healthcare, media and the arts in Miami Metro and Palm Beach are foreign-born. This is surpassed in the US only by San Jose, CA at 47%. What this means is that talent in South Florida is truly bicultural, not only in terms of languages, but in terms of doing business.

- Industry differentiation: Strong verticals can be built around Florida’s industries where there is a great concentration of capital, knowledge and networks. These include real estate and construction, healthcare, logistics and transportation, travel and hospitality, and aviation and aeronautics. And hopefully we’ll see South Florida emerging as a pioneer for climate change-focused startups.

- Taxes! Among other tax benefits, the State of Florida doesn’t collect individual income tax.

- Good quality of life: Last but not least, Miami has been recognized for the great quality of life it can offer. According to Livability.com, Miami ranks #4 in Healthiest US cities to live in. Although this is not everything, it is definitely something that talent considers when deciding where to invest time and resources to build a company and potentially a family.

Invest in talent

There are two sources of talent for South Florida (and in general): local and imported. Universities and coding schools are currently producing high-qualified local talent at junior levels. However, the region continues to lose brain power to other cities in the US. Further, the local market still is in dire need of more technical and product management talent, as well as mid-managerial talent in general. So we need to focus on both retaining and importing talent while the local capacity grows.

How is this done? No easy answer here. But investing in local startups and incentivizing foreign startups to set up shop locally will help. As our ecosystem density increases, talent (and their families) will find it easier to move to or stay in Miami because if one high-risk startup job opportunity doesn’t work out, there are alternatives to move to locally.

Just as a market needs capital liquidity, it also needs talent liquidity. And this requires supply – talent – and demand – job opportunities.

Foster a risk-taking mindset to unlock capital and markets

I truly believe every startup is always in need of 3 things: access to talent, access to capital, and access to markets. We already spoke about talent. So what about capital and markets?

Capital liquidity is critical to support the growth of any entrepreneurial ecosystem. South Florida has no lack of capital, but it’s just not readily accessible to be invested in high risk / high return endeavors. To all the investors out there in the region, I say to you: Invest in the startups that will create the markets of the future, so you can continue to participate from the wealth created by businesses that are changing the rules of the game at an extraordinary pace. And if you are in real estate, invest in the success of your future tenants!

Access to markets is the missing piece of the puzzle and can be unlocked through Corporate Innovation Engagements that create great value both for startups and corporates. So to the corporates out there, I say: Recognize what you are good at: deep industry expertise, deep pockets, distribution channels, brand recognition, and think about how these assets can be a great platform for digital transformation and innovation when you pair up with a startup. These engagements will grant you access to innovation and technology, talent you wouldn’t typically be able to attract, speed of operation and time to market, and potentially new markets you haven’t been able to tap into.

Startups: Think big

I have seen many startups in South Florida that are “me too” businesses, addressing local markets with a differentiator for a niche segment. In contrast, I have also observed that the lack of local capital forces some startups to be much more resourceful and find ways to scale more efficiently and reach profitability sooner. So I encourage startups to leverage these skills, focus on the verticals where the region is stronger, and set out to build business that can be relevant at a global scale.

Connect Florida internally and externally with the Southeast

Florida can profit from further connecting with internal hubs of innovation – Miami, FLL, Boca Raton, West Palm Beach, Gainesville, Tampa, Orlando – rather than continue to work in silos. Further, Florida as a whole should seek collaboration with other Southeast hubs such as Georgia, the Carolinas, Texas, and Tennessee. The exchange of talent, expertise, mentors, sources of capital, and markets can only make everyone stronger.

Celebrate successes

Finally, I cannot emphasize how much we need to continue to celebrate the local successes. This is crucial to attract more and better resources, inspire the next generation of innovators and risk-takers, and make the pie bigger for all. But this is not “over-hyping” early successes that are still to be proven, an extreme that South Florida unfortunately often falls into. Rather, let’s focus on creating good quality content that tells the stories of successful founders in the region. These may serve as case studies that will inspire future founders, as well as attract talent and capital from around the world. In my opinion, Nancy Dahlberg is an example of good progress done in this direction, but we need still so much more.

In conclusion…

My vision is that Miami will become a truly global hub for innovation and entrepreneurship focused on diversity and strong verticals yet to be defined. I like to think that in the near future, when people think of building and scaling a startup in some of the industries mentioned above, South Florida will be the top of mind place to move to succeed.

This is of course a work in progress, and only time will tell what shape this ecosystem takes, but I remain confident and optimistic that whatever turns out will be exciting, and the journey to help make it happen more than makes up for it!

Finally, I recognize that 500 Startups Miami humbly stands on the shoulders of giants, and our success in helping to fill the gaps and accelerate the local ecosystem will depend on our fruitful collaboration with all local players to the benefit of the founders that we support. We’re so excited to be on this journey!