Dear Partners of 500 Global,

It is hard to believe that we’re already one month into 2024. Here at 500 Global, we’ve hit the ground running. To kick off the new year, I want to highlight some notable trends we saw playing out towards the end of 2023 that we believe will shape the direction of 2024 and beyond for venture and tech. I’m also excited to share some news about a highly sought-after company that 500 Global is investing in and how it aligns with our thesis on AI.

Thawing of the IPO Market, Funding and a Focus on Strong Performers

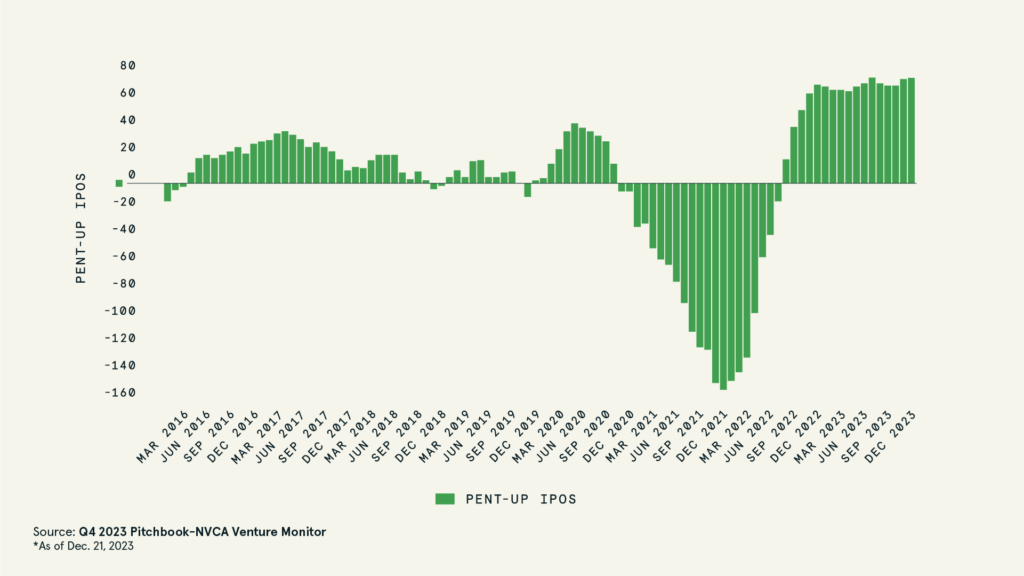

Towards the end of 2023, we saw VC-backed IPOs in the US seeing a modest uptick. The number of IPOs in the US grew 15% from 2022 according to Ernst and Young. Many saw this as early signs of the previously frozen IPO market beginning to thaw. One of those candidates is Circle, which acquired our former portfolio company, Cybavo, and has reportedly confidentially filed for a U.S. IPO.

We believe 2024 will be an excellent time to invest in venture and in startups. The tougher fundraising climate will force founders to operate with even more discipline, capital efficiency, and ingenuity than ever before. Valuations have corrected from 2021 highs across the board from early to late stage. More and more founders are building within AI or utilizing AI technologies to reimagine sectors in need of disruption. With the increasing amount of high-quality talent globally, we at 500 are excited to invest in this generation of new companies.

Innovation Within the AI Platform Shift Will Accelerate

In this quarterly letter, I’d like to focus our sector insights on everyone’s favorite subject, Artificial Intelligence (AI). Our Managing Partner, Tony Wang, recently presented a framework for how investors and founders can think about this space broadly, applying previous platform shifts to this one as well as understanding where innovation is likely to occur up and down the AI tech stack. You can find the recorded webinar here.

We believe that we’re still in the early innings of this AI platform shift. From faster and better AI chips and better testing and deployment to more efficient and effective large language models, there are a lot of opportunities for disruptions emerging, despite some of the seemingly FOMO-based valuations in a number of AI startups. We’ve been making investments in AI for years and continue to believe in not just the power of AI and the opportunities ahead, but that the best founders will come from and build innovative technologies in all corners of the world.

One example of this is our recent investment in Sakana AI – a world-class AI research lab at the forefront of AI innovation. Based in Tokyo, Japan, Sakana AI is founded by David Ha, ex-Google Brain and Stability AI, and Llion Jones, also ex-Google and one of the co-authors of the 2017 Google Transformer whitepaper, “Attention Is All You Need,” often noted as the launching point of the current GenAI wave. We invested in Sakana AI’s $30M seed round alongside Lux Capital, Khosla Ventures, Jeff Dean, and other notable VCs and angels. We’re excited to partner with David, Llion, and the Sakana AI founding team as they push the bounds of AI research by exploring alternative approaches to more adaptive, resilient foundation models.

Developments in this space aren’t just surfacing innovations in Generative AI; they are also democratizing the ability to create new startups across sectors and turbocharging innovation by empowering founders with streamlined tools, reducing costs, and opening doors to bold experimentation. We see a lot of parallels to what happened at the beginning of the 2010s, when new web and cloud platforms decreased the costs to start a company and the need for capital. As a result, we believe we’ll see a new class of startup founders and startup investors emerging. We’re starting to see this play out in our Global Flagship Accelerator Program. Our upcoming Spring Demo Day on March 6th includes at least nine companies either innovating in AI or using AI to enhance another sector like Legal, Edtech, or Travel and Logistics.

Being a Sure Mover As VC Enters a New Era

Since 2010, we’ve been first-movers in global investing, often being one of the first Silicon Valley venture firms to invest in new markets around the world. However, we also believe that a measured and mature approach can result in a “sure-mover” advantage that can help reduce risk but still generate the potential for highly competitive returns. This approach is based on an understanding of tech trends while using the data and insights from 13 years of global and hyperlocal operations backing nearly 3,000 portfolio companies, as well as leveraging tens of thousands of accelerator applications, pitch decks and more from companies from pre-seed to pre-IPO. For example, we’re excited about AI innovation, but we know it’s still in the early innings of this platform shift. We’ll remain disciplined in our investments and leverage our global expertise to seek out new opportunities, help our existing portfolio, and more.

Hear more from our Managing Partners around the world:

-

- COO and Managing Partner, Courtney Powell, participated in The Forum Interviews at the World Economic Forum’s Annual Meeting in Davos about the future role of venture capital in building startup ecosystems

- Managing Partner, Khailee Ng presented data from the 500 Global Rise Report at the Khazanah Megatrends Forum

- Managing Partner Vishal Harnal spoke at SALT iConnections Asia on The State of Venture Capital Investing in Asia

- Courtney Powell spent time at Abu Dhabi Finance Week and at the Fortune Global Forum speaking in sessions on:

We’d love to hear from you if you have any questions or thoughts to share. Reach us at ir@500.co.

Thank you and Happy New Year,

Christine Tsai

CEO and Founding Partner, 500 Global