Fund Budgeting & Cash Flow Management

What are the financial nuts and bolts of launching and managing a venture fund? How does fund budgeting interplay with portfolio construction, and what are some best practices?

Andrew Brown, Director of Pre-Close Services at Carta, walks through an example Operation Planning Model, covering topics including:

- Data Entry

- Management Fees

- Cashless Capital

- Management Company Budget

- Fund Budget

- Portfolio Construction

Below are some highlights transcribed from the video.

Note: Andrew walks through a fund budgeting template hands-on. Read the transcript below to understand highlights.

Operational Planning Model:

During this webinar, we are going to dive in and walk through an example Operational Planning Model covering cashless capital, management fees, match company budgeting, fund budgeting, and touch on the first level of portfolio construction. I work on this with all of our clients who come through the Pre-Close team at Carta.

Data Entry:

{3:35}

Start with data inputs.

When thinking about budgeting, we’re saying we are ambitious and we are closing the fund on one. Let’s say for example our first close is going to be $2 million, and we’re going to target a $10 million dollar fund. For first closes, I like to see them around 15% to 20% of the target (at a minimum). For this example we’ll use $2 million, saying 20% of $10 million.

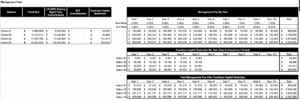

GPs are typically 1% of the venture funds. Here, we are projecting if we run a $10 million fund, our fund will actually be $10million and change. This is the assumption we will go off of for the rest of this example.

How do I choose my fund management fees?

One of the first things when starting your VC fund is determining management fees. How do you pick your management fees? When it comes to management fees, think about it as the cash that the management company will receive on an ongoing basis to keep services and operations of flow for the brand.

What I traditionally see is 2 and 20. While a 2% management fee is still the most common fee I see, in today’s climate, some people are front loading fees a little more aggressively. It’s very common to do something like two and a half to three and a half percent, for the first couple of years and then step down a little bit later.

The larger management fee can be beneficial- it allows you to have ongoing cash. However, remember that this is the biggest expense of your venture fund. So the more we spend, you have less we can invest.

What is your fund Investment Period?

It is important to determine how long you are going to make your investments for. This is for initial investments, not follow on. I typically see five years, though some people are more aggressive.

Cashless Capital

{6:43}

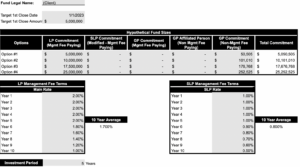

Using a cashless capital mechanism is very common for funds under $20 million. Think about this as a tax effective mechanism to change ordinary income to long term capital gains, which is typically a better tax treatment. To do this, focus on your capital commitment. In our example, our capital commitment is 1%. You want to pick some kind of ratio. The most common ratio I see is 80/20 – which means 20% you put in cash and 80% is cashless.

20% of $100,000 is 20k which makes 80k the delta. That delta of cashless capital will reduce our management fees. Over the life of the venture fund, your capital call schedule is no longer 100k – it is now 20k. You have to put 20k into the fund over the lifecycle.

Management Fees

{7:44 }

Using our above example, we have our $10 million fund and a cashless offset of $80,000. If our management fee is 2%, this fund is expecting $200,000 coming into the management company.

To make things easier for GPs, we need to offset this $80,000. We are going to take the $80k divided by 5 periods (see below) to get our reduction. By doing this, we have effectively reduced your income. Cashless capital is a common and friendly mechanism, but it does affect our management company budget.

Management Company Budget

{9:09}

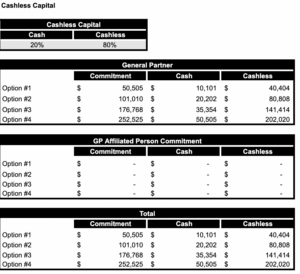

When building your management company, be as robust as possible so it checks all of the boxes. Some things to think about when you are starting to make operations and thinking about running your brand include:

- Are you going to make hires?

- Are you going to have consultants?

Start with your $10 million fund and our management fee. Then account for all of your expenses. This will include:

- Employee expenses

- Owners benefits

- Rent

- Service fees

- Travel

- Tax prep

- Utilities

- Etc.

Remember these are not venture fund expenses, these are the management company related expenses.

At the bottom, after your expenses , you will have your cash left for GPs. We want to build the right budget for the management company and make sure we are comfortable with the bottom line.

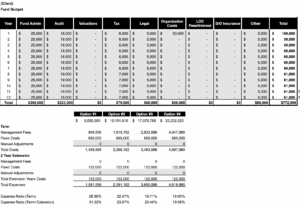

Fund Budget

{10:43}

Remember, your management company budget is different from your fund budget.

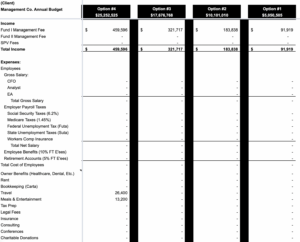

Venture funds are typically a 10 year fund and usually have 2 extension periods. I always model out those extension periods so below is a 12 year model.

We start with the most traditional expenses that I see out of a venture fund. There will likely be more aspects, but I’ve built this budget optimized for investable capital.

Each of these expenses will vary based on your fund size and your situation. For this example:

- Fund Admin: $20,000 for a $10 million fund is fairly reasonable.

- Audit & Valuation: These expenses may come up for a fund around $25 million and over. Typically, LPs will dictate whether it is necessary or not.

- Tax: Tax returns are common. If your AUM goes up or you have a lot of foreign investors, this number could go up.

- Legal: Anything related to portfolio investment, limited partners, compliance, etc. A $10 million fund will not have a ton to spend on legal.

- Organizational Costs: Formation marketing, filing, travel fees.

- Line of Credit: N/A for a fund this size

- D/O Insurance: N/A for a fund this size

We want to optimize for expense ratios. Again, you have that large management fee and all your additional fees that add up. In this example, we’re showing a 21% ratio for a fund running a 2% management fee, which is great. For a fund with this management fee, the expense ratio really should not go higher than 22%. In this example, we are optimizing for investable capital very well here, so we can feel good about this.

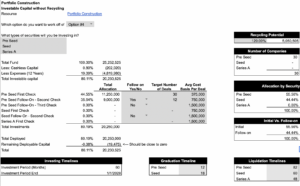

Portfolio Construction

{14:25}

In order to determine portfolio construction properly, we need to think about expense ratio. What this is telling us is 20% of this fund is not going to be investable unless we have other recycling mechanics. A $10 million fund really only gives us $8 million guaranteed to work with. Let’s model out what that means.

Cashless capital and our 12 years of expenses is in total about $2.1 million not coming in. The next step is figuring out how to allocate this $7.9 million. Everyone’s strategy here will be different.

To keep this simple, let’s say we are going to do 25 checks at $175,000 per deal.

When I model out follow ons, I typically project 40% of our companies will need follow in if we choose to do that. That would mean there are 10 companies here that need follow up. In this example, let’s double the price of the round to $350,000. You can see the model (below) is working when your remaining deployable capital is close to 0.

Recycling Potential

Most LPs have a recycling clause which means if the fund has some early liquidations, you can put X% back into the fund. This gives you a little more room to update your portfolio construction to give you some more bandwidth. I typically do not model for it because it is not guaranteed.

Another thing to think about with recycling is, as emerging managers look to raise funds 2 and 3, the metric of DPI (Distribution to Paid-In Capital) is a really great metric to have.

Assumptions

LPs will often ask about projections for returns. We can use the below model to make assumptions. Focus on what your projected multiples could be for the fund. You can see below each investment, purchase price, follow ons, etc. This will show us what our prospective exit multiples could be for the fund and where we want to market it. We need to reasonably make these assumptions so there will be some write offs, breakevens, etc.

About Carta

Andrew Brown runs Carta’s Pre-Close team. He works with hundreds of emerging managers to guide them through fund budgeting and cash management.

Listen to the full webinar recording below to hear Andrew’s Q&A session and learn more about Carta’s Pre-Close services.

To be informed of upcoming webinars and blogs, join our mailing list