In August 2021, Bukalapak made news as the largest listing in the history of the Indonesia Stock Exchange (IDX). Its mission is bold: to create a fair economy for all. All, but more precisely the micro, small, and medium enterprises (MSMEs) in Indonesia – affectionately known as Mitras.

Yet, eight months after going public, the company made a series of high profile announcements: The appointment of Willix Halim as new CEO, the purchase of a stake in digital bank Allo Bank, a foray into groceries delivery through AlloFresh, and an expansion into gaming. One may ask, what does all this have to do with Mitras and how does this drive Bukalapak’s value?

This article seeks to make sense of public information Bukalapak has shared about its Mitra strategy, as well as how the company’s value can be gauged. We’ll start by looking at the outcome of the strategy itself.

Is the Mitra strategy working?

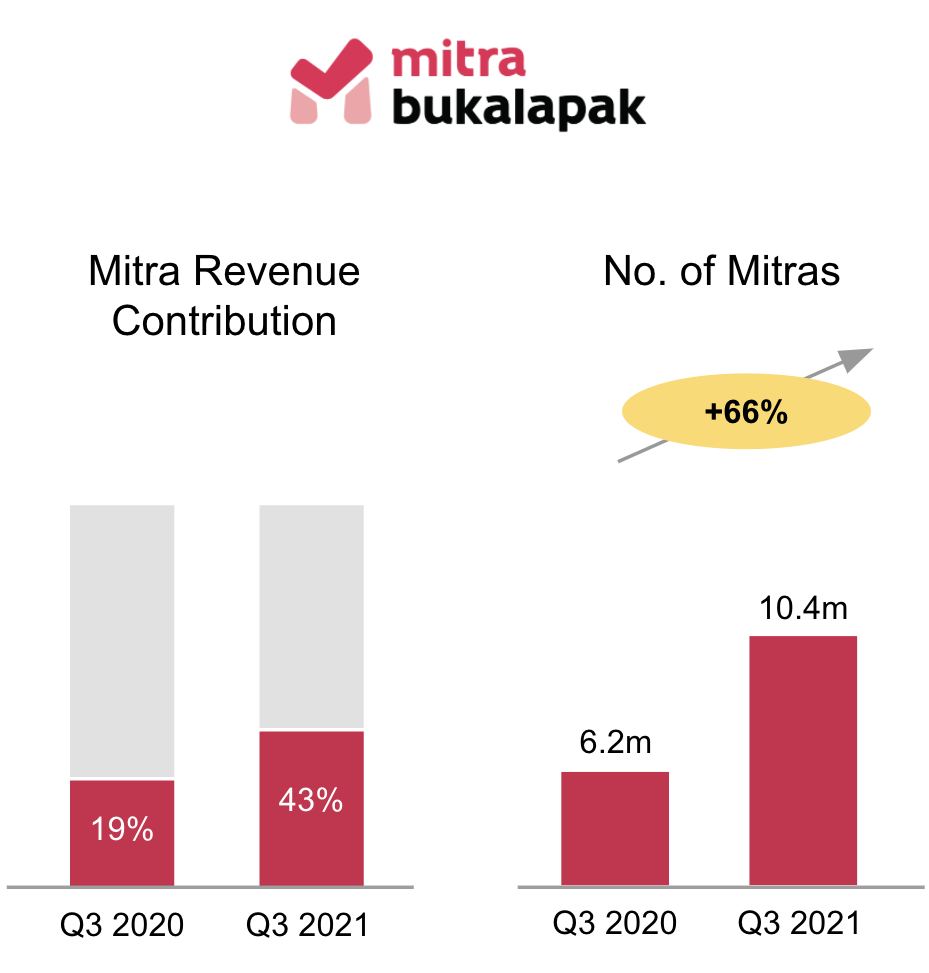

Between Q4 2020 and Q3 2021 (the company’s most recent publicly available numbers), the number of Mitras in Bukalapak’s network grew by 51% from 6.9 million to 10.4 million. This means the company added 3.5 million more Mitras to its network in just 9 months. Between Q3 2020 and Q3 2021, the network’s contribution to total revenue increased from 19% to 43%.

Source: Bukalapak Q3 2021 Results

Bukalapak achieved this growth while being in the thick of the pandemic. With over US$1.6 billion in cash as of Q3 2021, and a rebounding local economy, the company believes it can build on its momentum with the Mitras.

Helping Mitras grow

To help Mitras grow their business, Bukalapak made a few acquisitions:

- In May 2021, it acquired 500 Global-backed Itemku, and made an investment in YGG SEA. This allows Mitras in its network to participate in producing and providing virtual game items for Indonesia’s growing gamer population.

- In January 2022, it acquired 11.5% of publicly-traded Allo Bank, with the intention of making banking available to Mitras.

- In March 2022, it launched AlloFresh through a joint venture. Bukapalak owns 35% of AlloFresh, which touts a three-hour delivery for over 150,000 grocery items, with the goal of making fresh groceries available to Mitras.

Impact of the Mitra strategy on financial performance

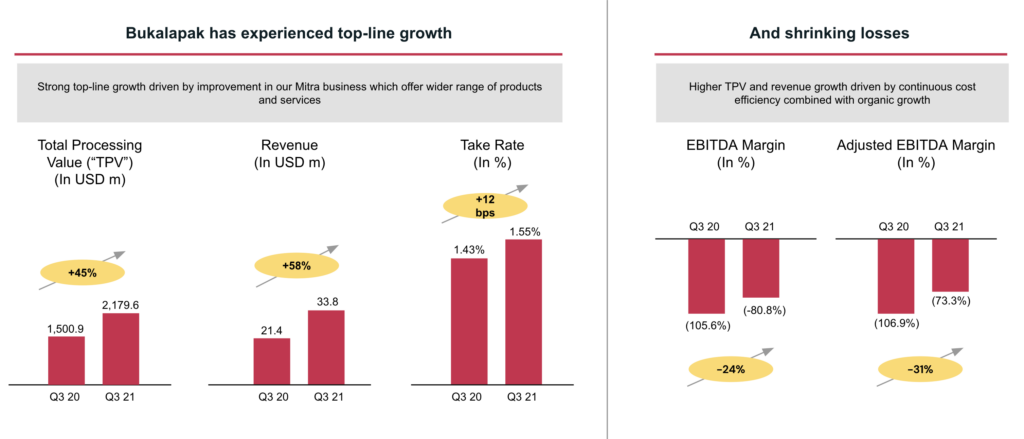

From Q3 2020 to Q3 2021, the company’s overall total processing value (TPV) grew 45% from USD$1.5B to US$2.1B; total revenue increased by 58% from US$21M to US$34M; take rate jumped by 12 basis points. We believe the growth in Mitras contributed to the increase in overall TPV and revenue, and the Mitra take rate showed a robust uptrend. All this alongside improved EBITDA margins.

Source: Bukalapak Q3 2021 Results

Competitive positioning

How does Bukalapak compare with other tech giants in Southeast Asia that are publicly-listed, or may go public this year?

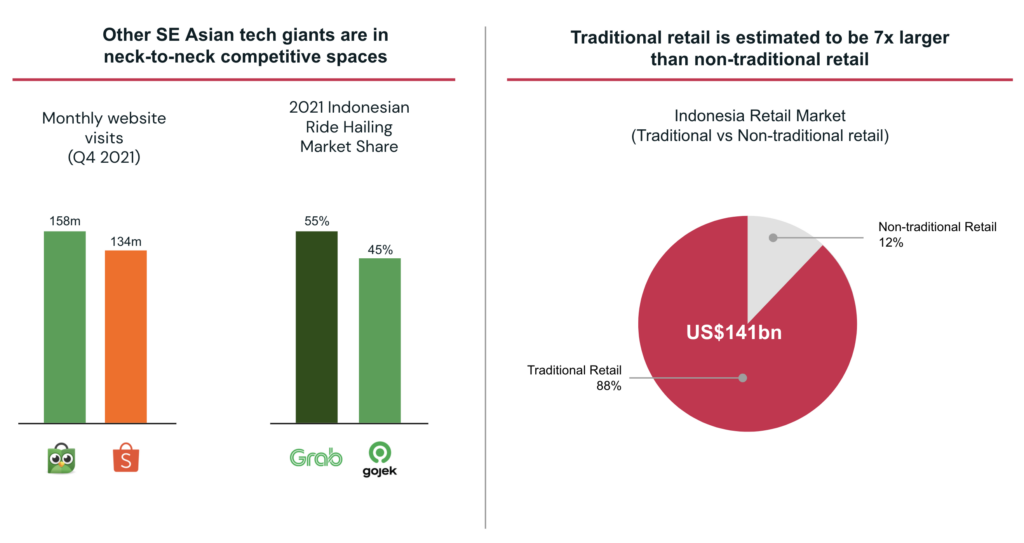

While the core business of SEA Ltd’s Shopee and GoTo’s Tokopedia is e-commerce marketplaces, and Grab and GoTo’s Gojek core is in ride-hailing and food delivery, in our view Bukalapak seeks to differentiate itself by having Mitras as its core business.

Bukalapak is a market leader in the online-to-offline (O2O) segment with 42% market share. According to the company’s estimates, this segment of traditional retail (offline) is seven times the size of non-traditional retail (online) in Indonesia as of 2020.

Source: iPrice The Map of E-commerce in Indonesia as of Q3 2021, Measurable.ai Report, Frost & Sullivan

Source: iPrice The Map of E-commerce in Indonesia as of Q3 2021, Measurable.ai Report, Frost & Sullivan

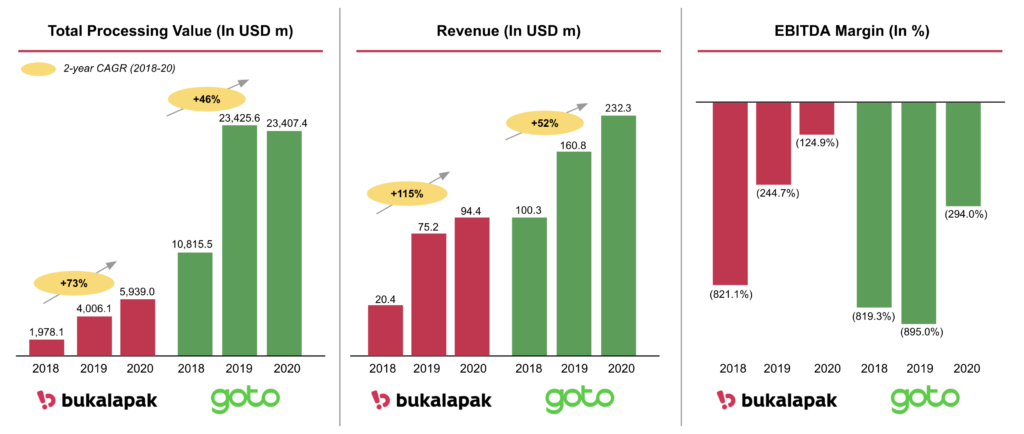

Based on a comparison of Bukalapak’s TPV, revenue and EBITDA margin against GoTo’s financial performance between 2018 to 2020, we are of the view that the Mitra business model appears to make better progress towards profitability.

Source: Bukalapak Prospectus, GoTo Initial Prospectus, S&P Capital IQ

Source: Bukalapak Prospectus, GoTo Initial Prospectus, S&P Capital IQ

So, what is the true value of Bukalapak?

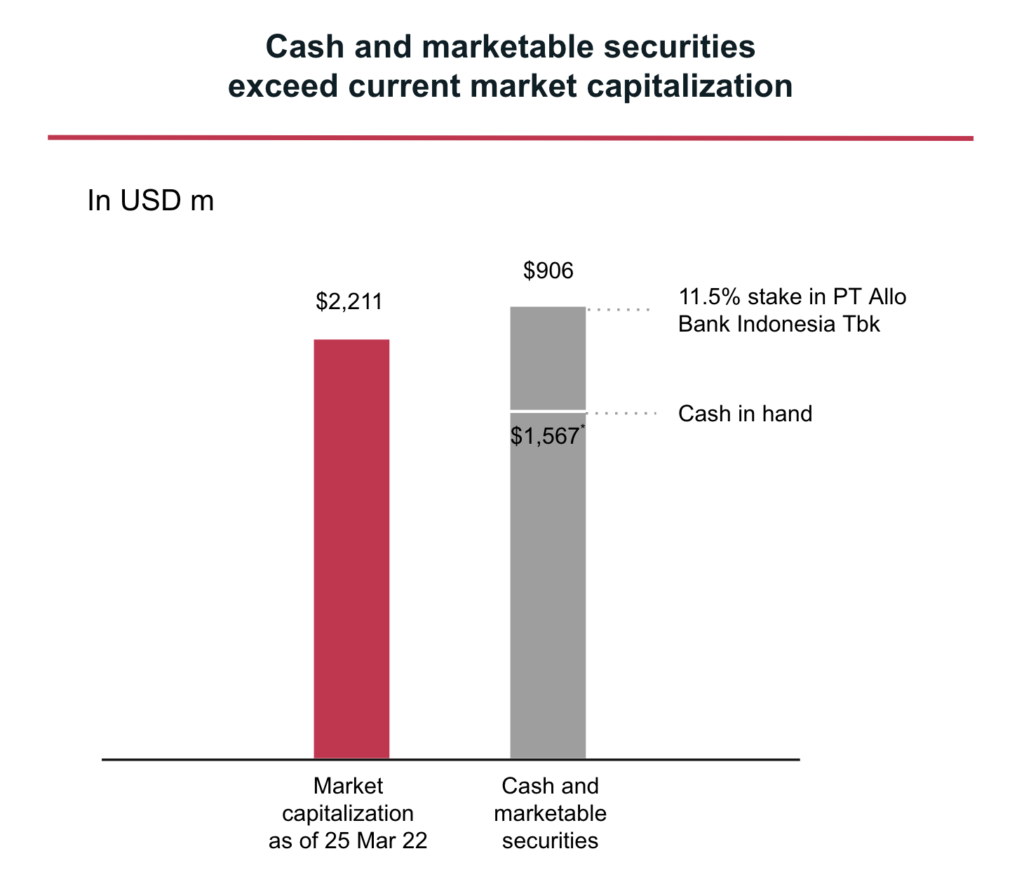

The cash and marketable securities the company has on-hand as reported in its Q3 2021 financials (US$1.6B), together with its 11.5% stake in Allo Bank (US$906M), exceeds its market capitalization of US$2.2B as of 25 March 2022.

Source: S&P Capital IQ, Yahoo Finance

*Cash in hand based on cash outstanding as of 30 September 2021 after subtracting investment cost in PT Allo Bank Indonesia Tbk.

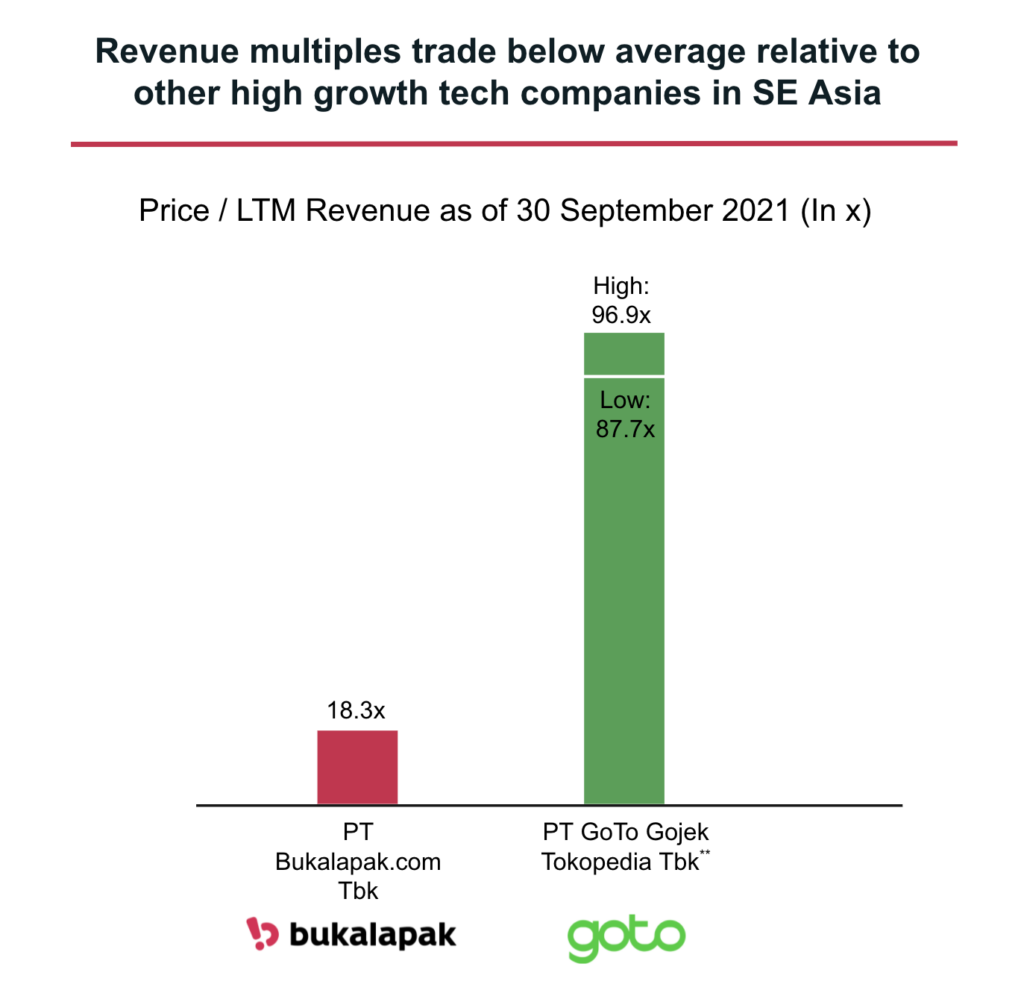

Another lens to view it is through its revenue multiple relative to tech giant, GoTo, which announced plans to go public. One can also argue that despite its intrinsic value, Bukalapak is trading at a lower Price-to-Last Twelve Months Revenue (P/LTM Revenue) compared to our estimates of GoTo’s indicative P/LTM Revenue.

Source: S&P Capital IQ, GoTo Initial Prospectus, DealStreetAsia Article

**Based on PT GoTo Gojek Tokopedia Tbk’s listing valuation range of USD 26.4B to USD 28.9B, and estimated annualised 7-month net revenue (1 January 2021 – 31 July 2021).

The Bigger Picture

While short-term fluctuations in stock prices can be influenced by a variety of factors, here are some bigger questions one can ask about the long-term: What is the growth of the Indonesian economy? Will the rest of Indonesia want faster, on-demand grocery? Will they want more financial products, gaming, entertainment? Will Indonesia’s smaller cities grow? The answers play key roles in Bukalapak’s Mitra strategy.

Bukalapak’s management team embarked on this visionary Mitra strategy in 2018, and continues to support it. One key team member who has led the success of this strategy and its growth is Willix Halim.

I first recruited Willix to be a growth mentor for 500 Global’s Growth Hacking Workshop Series in 2016. When I asked Bukalapak’s team what they learned from Willix, they said “We must hire Willix.” We spent six months convincing him to join the fledgling startup, and by the end of that year he joined as Chief Operating Officer.

Trained as a data scientist, and experienced as an early team member of Freelancer (ASX:FLN) all the way through post-IPO, Willix spent the last five years operationalizing strategy at Bukalapak with great precision. Much of the visionary strategy and growth results can be attributed to his leadership. We continue to be impressed by his ability to deliver.

We hope this article gives an understanding of Bukalapak’s Mitra strategy, its momentum, and how to better gauge the company’s value as a result.