2017 was a landmark year for the MENA startup ecosystem. That hectic pace of development has continued, even accelerated in the first month of 2018. Having been in the MENA startup space in one form or another since 2007, looking back on what has happened in the past year astonishes me. The rapid pace of development, growth and maturity that took place over the last year is astounding. So, below I wanted to document a few of the main developments I’ve seen from my personal perspective in 2017, which I hope to see continue in 2018.

An increasing government focus on entrepreneurship

TL;DR – Almost every government across the MENA region has woken up and is actively supporting the startup ecosystem.

Governments across the region have fully woken up this year and have started to actually implement projects to help their nascent startup ecosystems grow. In 2017, we saw the emergence of Saudi Arabia as a key player in the regional startup space, with the focus that Crown Prince Mohammed bin Salman has placed on technology and innovation as a pillar of economic growth. Projects from the SME Authority, MiSK, and even the private sector have led to the emergence of a real funding ecosystem, and we hope to see more in the next year with the launch of the SMEA Fund of Funds program.

Bahrain has also launched the Startup Bahrain initiative, an interesting collaboration working both from the government’s perspective and forming a grassroots movement on the ground. This, in addition to a unique fund of funds program and a fintech sandbox environment has led to Bahrain’s emergence as an interesting ecosystem in the GCC.

The UAE has had some significant developments over the last year, with several initiatives not only from Dubai, but also other emirates such as Abu Dhabi, Sharjah and Ras Al Khaimah. Dubai, with its flagship Dubai Future Foundation, has been a driving force in the region, with projects such as the Dubai Future Accelerator program and Area 2071 leading the way in building a nurturing environment for MENA startups in the emirates.

In North Africa, we saw Morocco emerge as a hub not just for MENA, but with a wider focus on Africa. We’re seeing projects such as a fund of funds launched in partnership with the World Bank to develop a venture capital ecosystem in Morocco starting to take shape, and we expect to see a lot more in the next year. Projects in Tunis, such as the Founders Institute and Flat6Labs, backed by BIAT as a driving force in that ecosystem, are starting to develop more founders at a higher quality than before.

In Egypt grassroots private sector led initiatives took the lead in building the ecosystem there, with Rise Up becoming a key integrator and supporter across the ecosystem. We saw the launch of Egypt Ventures, a government backed initiative to support VC funds, accelerator programs and invest in startups, as well as a few new VC funds start to make their first investments, such as Algebra Ventures and Averroes Ventures. A new angel group, Alexandria Angels, was also launched and we hope to see more in the future. The government also launched the Sherketak accelerator program to further support startups in Egypt. The nation has emerged as a true ecosystem, with amazing founders, a healthy funding ecosystem, with active participation from that both the private sector and government sectors entities.

In Jordan, we began to see an increase in momentum, with Oasis500 working on expanding further and the launch of the Beyond Capital fund of funds program and we hope to see more in 2018. With the acquisition of Carriage, the Kuwait-based food delivery startup, Kuwait has now had more $100m+ tech startup exits than any other market in the GCC. The Kuwaiti ecosystem has developed into a strong source of deals and, dedicated, motivated founders, as well as new angel investors actively investing in the region. Qatar was also active in the region through Qatar Foundation and the Qatar Science and Technology Park, with new funds and an enlightened view of not only focusing on Qatar but supporting the development of startups across the MENA region. A new market, Oman, launched the Oman Tech Fund program, a VC fund and Accelerator program, as well as IDO a government and private sector backed VC fund. Oman has always been a great place to visit, and we hope to see more founders emerge from Oman and more founders from the region use it as a base of operations.

What I’d like to see more of however is collaboration and co-operation between the startup and ecosystem project across the region. The issue is that no single market on its own is attractive enough or big enough to emerge. We need to see projects and initiatives that focus on the Arab world and MENA region as a whole, not just country-specific programs.

Societal acceptance and celebration of tech and entrepreneurship

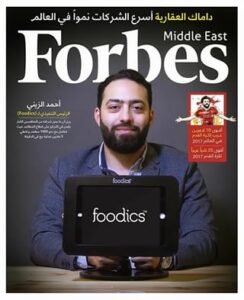

An extremely positive side-effect of the new top-down focus on entrepreneurship, tech and startups has been a greater awareness of our industry, acceptance of being a founder as a career and even significant celebrations in mainstream media related to founders and the ecosystem.

I remember just a few years ago when “startup” and “entrepreneur” were terms of derision and misunderstanding. The large funding rounds and exits we saw in the past year have further helped to show the opportunity in this sector to the wider populace, and I hope to see this trend continue.

Emergence of corporate activity in VC

With the Souq.com deal and others we’ve started to see regional corporates dip their toes into the startup arena. Majid Al Futtaim (MAF) and Emaar Malls made bids to counter Amazon’s offer, and both have started to become active investors and acquirers for startups in the region

We’ve also seen AlTayyar group in Saudi Arabia put startups and tech as a key part of their strategy after successful investments in Careem and Moasafer.com. UAE Exchange has also made it part of their mandate to invest in and acquire startups that would complement their core business. These are just a few prominent examples, however this is a significant development. In previous years most corporate players in the ecosystem were mostly playing a role as sponsors and as part of their CSR activities.

Emergence of new regional investors

This year saw the emergence of a new breed of active VC investors, widening the pool of capital available to startups. VCs such as Raed Ventures, Riyad Taqnia Fund, Vision Ventures, Sharq Ventures, KISP Ventures, QSTP, Oman Technology Fund (OTF), Faith Capital and more.

I’m hoping this trend continues, as more players will help more startups get funded and widen the pool of capital available across the region.

Increasing interest from outside investors

In 2017 we saw investments in the region from investors in China, South Korea, Japan, South-East Asia and Europe. China’s ride-hailing giant DiDi Chuxing and Japan’s e-commerce conglomerate Rakuten invested in Careem. Jollychic has made a few investments and GS Shop, South Korea’s international home shopping and e-commerce giant, is actively looking at the region.

I believe we’ll be seeing more Asian investors enter the region as they see the parallels between the MENA region and Southeast Asia. Investors from Japan, Korea and China have played a significant role in the development and growth of the South East Asian market. We will likely see these investors as active acquirers, or late stage (Series B+) players, as they have been in Southeast Asia.

European investors are also taking a closer look at the MENA region, seeking to expand out of low growth areas into the high growth and opportunity in the region.

More dealflow/ better deals

This was the best year yet for deals, both in terms of quality and quantity. Founders in the region have matured and moved away from trying to raise funding for ideas. We are seeing fewer part-time founders or “wantrepreneurs”, and more founders that launch, get traction, and build real businesses first and then raise funding. I love this.

That’s not to say this increase in dealflow hasn’t come with a downside — I’ve seen several deals with less than scrupulous founders taking advantage of new investors by raising large amounts of money based on nothing more than pitch decks with a few sexy terms like “blockchain” , “fintech” or “AI” thrown in.

Existing VCs moving up higher in the food chain

As some of the first generation of VC funds in the region start raising larger funds, we’re seeing a natural progression towards later-stage companies. Funds that had previously focused on Seed and Series A deals are now looking to deploy larger amounts into Series A and Series B deals. This is not to say that they have stopped seed and early investing, but are doing those investments more to guarantee their allocation and dealflow at the later stages. Being active investors primarily at the Seed stage, this has left a bigger opportunity for us to fill. This has also benefited the ecosystem as the Series A and Series B gap has started to get filled, hence we’re seeing a lot more series A deals taking place.

500 Startups MENA year in review

At 500 Startups, we’ve had an exciting year, with the first closing of our MENA focused fund at $20m, as we continue to raise to hit our $30m target. We launched our first growth-hacking Dojo Program for post-seed / pre-Series A startups, with nine startups that have successfully completed the program.

We’ve completed more than 30 investments, and emerged as the most active VC fund in the region within less than a year. We hope to continue to play a significant role in helping to develop the regional ecosystem, invest in great startups, and help bring relevant Silicon Valley knowledge here to continue to accelerate our region’s growth and potential.

My hopes for 2018

I don’t like to make predictions, I like to work to help make a change. There are three main areas where I’ll be actively working on this year to help develop the regional startup ecosystem.

A MENA jurisdiction for startups

I hate the fact that I have to ask startups based in the region, from the region, targeting the region, to incorporate in the BVI or Delaware to ensure we’re able to have the most basic protections as investors.

I would like to see an onshore jurisdiction emerge as a de-facto option, a well-understood and accepted place for startups and investors to use.

I’m hoping that 2018 is the year we see this happen, along with a standardisation of equity and convertible notes documents. We’re hoping to work together with regional law firms and jurisdictions in the region to see this happen.

LPs

We’re starting to see several government-backed Fund of Funds programs emerge, which are a great help, as well as international development finance agencies playing a more active role.

However, we have yet to see the private sector play a significant role as LPs in regional VC funds. Many of the family offices and corporations in the region want to invest directly, and the larger sovereign funds are tasked with diversifying out of the region, and want to deploy funds which are too big for any of the VC funds in the region to absorb.

I am hoping to see more regional family offices and corporations look towards playing a role more as LPs and potential acquirers of startups, rather than trying to do direct deals themselves.

M&A activity

This is the big one – I hope to see greater regional M&A activity in 2018.

The MENA region, even in more traditional industries, has been weak in consolidating smaller players into potentially global competitors. You see this in many industries such as the financial sector and insurance, as well as trading and manufacturing. My hope is that the new entrants into the startups and tech ecosystem will take a more active, positive view towards acquisitions and consolidation.

This will become a key driver as the regional ecosystem continues to develop.The emergence of several more regional acquirers would lead to more exits and another transformative year for the MENA startup ecosystem.

The road ahead looks bright

The changes over the past year and the pace of development and focus on the entrepreneurial ecosystems in the region have led to a simple conclusion: 2017 was a great year for MENA startups and this year looks to be even better!