Best Practices for Portfolio Construction

Portfolio strategy and construction are a key component of any VC fundraise. Anubhav Srivastava, Founder and CEO of Tactyc, walks through tips to build a compelling portfolio construction model and how today’s market dynamics are impacting the conversation with LPs.

Stay in the loop on upcoming webinars, new blogs and VC Unlocked updates.

Portfolio construction is often thought of as just a model to be built for raising funds and sharing with investors. However, successful fund managers view it as a constant, iterative workflow that can guide fund performance even after launch. By building a forecast and tracking the deployment of capital, managers can identify if they are deviating from their plan and make necessary adjustments, creating a powerful feedback loop. Despite its benefits, many managers don’t engage in this process because it can be difficult to manage in spreadsheets, where version control and the ecosystem can be limiting. However, there are faster and more efficient ways to do this, making scenario planning and forecasting easier and allowing your fund to make stronger data driven allocation decisions.

Inputs

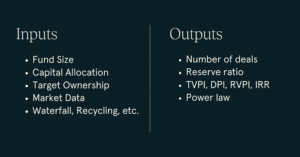

First of all, portfolio construction can be approached in various ways, with Excel models being commonly used. There is often confusion about what aspects should be inputs and outputs in such models. Fund size and allocation of capital are important inputs, as are deal preferences (e.g. stage and amount of capital) and desired ownership in portfolio companies. Market data is also crucial for informed decision making, particularly for sector-focused funds. For example, a FinTech-focused fund would benefit from having round sizes and valuations informed by the actual market dynamics in the FinTech sector. There are inputs like waterfalls, recycling and other advanced provisions as well. Start by considering these inputs carefully to develop a well-constructed portfolio.

Outputs

Number of Deals

The primary output to solve for in portfolio construction is the number of deals, which essentially determines the size of the portfolio. The most common mistake we see, particularly among early stage funds, is aiming for too small a number of deals. For instance, if you’re a sub-$50 million or sub-$80 million pre-see or seed investor, you should aim for a magic number of 30 to 35 deals rather than just 20 to 25. The reason being that the power law curve still applies, and you’re still counting on one or two deals in your portfolio to generate exceptional returns of 10x, 15x or 20x. Having enough critical mass with sufficient shots on goal is necessary to achieve this. Number of deals should be the first output you solve for.

Reserve Ratios

We often see too much emphasis being given to reserve ratios, while the number of deals is the most important factor to consider. Sometimes fund managers will try to dictate their desired reserve ratio which may not always be possible based on the inputs and the markets that you’re dealing with. Your reserve ratios should be based on more granular assumptions such as how many deals are expected to graduate from one round to the next, and whether they plan to follow-on into every single company or maintain a pro rata. These small inputs will eventually give you a reserve ratio. But reserve ratio itself should not be an input. This is a common issue seen in Excel-based models, where too much is hidden under the hood. It is important to have a more detailed understanding of how many companies are expected to advance from one round to the next, which will help determine the reserve ratio.

Metrics & Power Law

An important output of portfolio construction is performance metrics. This includes DPI, TVPI, and projected metrics for the fund’s performance. The J curve analysis is also important, as it determines the payback period for the LPs. LPs are increasingly asking for the power law curve, which shows the distribution of exit multiples in the fund’s portfolio. The curve indicates how many companies are expected to have exit multiples of more than 10x, between 5x and 10x, or less than 1x. A strong understanding of this curve is crucial in defending and explaining the fund’s performance.

When it comes to portfolio construction, remember that this is a solved problem. This has been done by thousands of fund managers and there are best practices and things to avoid when building portfolios.

Best Practices and Common Mistakes

- Don’t reinvent the wheel. Portfolio construction is a solved problem.

- LPs are used to seeing construction strategies that fit within “patterns”. Don’t try to innovate too much on portfolio construction. Stick to tried and tested paths.

- Don’t build an ‘imagined portfolio’ with assumed exit multiples, Models need to be flexible.

- Assumed valuations & round sizes need to be supposed by real-world data

- Remember to reflect your “edge” in the model

- Solve for number of initial investments (at least 35-40 for early stage funds) and target ownership

- Be realistic about recycling. 70% + funds never reach their recycling targets

- Reserve ratios need to be supported by graduation rates.

It is no secret that this is a tougher market than the last seven years. There are a number of trends to keep in mind as you construct your portfolio and speak with LPs.

Recent Trends

Raising a Fund:

- Downsized commitments but no slow down in number of new GPs

- Sub $50mm market is getting increasingly crowded

- GPs have to understand that there is a longer fundraising cycle (around 18 months to even a couple of years).

- LP’s are asking for more defensibility in portfolio construction

- LPs are asking more questions about reserve ratios, assumed graduation rates, expected failures, etc. Have those answers ready to discuss with LPs.

- Anchor LPs asking for preferred terms (especially with EU-based LPs)

- We are seeing a pattern develop of more preferred terms like lower management fee or catch up features.

Active Funds:

- Lower mark-downs in diversified funds

- The mark downs so far have been mostly in web3 and crypto.

- More partial exits to lock in DPI gains

- It’s likely this trend will continue.

- Liq Prefs are starting to make a comeback

- In the last 2 months we have seen more Tactyc clients model out liquidation preferences than in the last 20 months combined.

- Strong internal portfolio reviews: what does the next 12-36 months of capital deployment activity look like?

- More transparency with LPs: Pro-actively sharing strategy for the down-turn

To take a deeper dive and walk through a live example of what has been discussed, watch our full webinar with Tactyc CEO & Founder Anubhav Srivastava. Tactyc is the first performance forecasting and scenario planning platform for VCs.

Stay in the loop on upcoming webinars, new blogs and VC Unlocked updates.