In 2010, 500 Startups started as a new kind of venture capital firm in Silicon Valley with a contrarian belief that talent can come from anywhere in the world. Back then, very few venture capital firms in the valley were focused on much outside of our collection of cities within the San Francisco Bay area.

”If you look at our early team, our DNA has always been very global with experience growing up abroad or working internationally. So it really comes down to the thing that we always say which is that we always believed from day one that there are brilliant startups all over the world, but opportunity isn’t universal.” – Tim Chae, Managing Partner at 500

As a small fund at the time, we started to grow internationally by starting small. Instead of investing in startups across the world that we had never really met, we started with what seemed most natural to us, which was literally getting on airplanes and meeting the startups and players in the ecosystems face-to-face.

A Look at 2019

After years of getting to know entrepreneurs, governments, and other stakeholders in key regions, the supply of great entrepreneurs only continued to increase and we have doubled down on our support for them. We are really proud of the accomplishments we have been able to make this year:

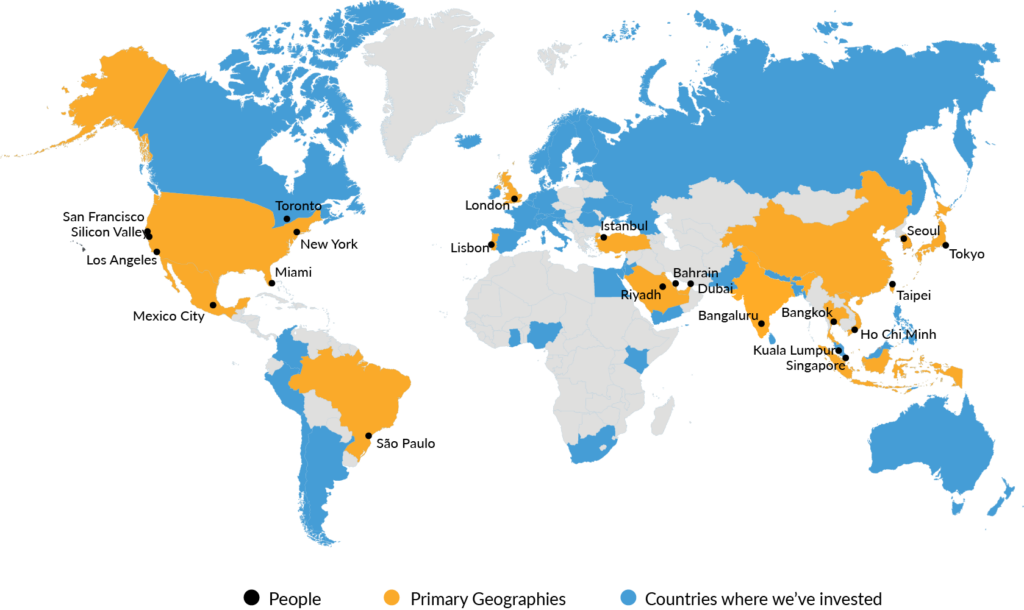

Over time, we have created thematic funds, run by entrepreneurs and experts from the regions who would be able to best understand each international markets’ needs and capabilities so we could continue to support founders everywhere. 500’s thematic funds are seed/Series A funds that focus on a particular region or theme. As of December 2019, 500 is operating 16 thematic funds covering regions including Southeast Asia, MENA, Latin America, and more.

So how do 500’s thematic funds really work?

As our international investment grew, we started to have tens of investments in certain key regions that eventually led to the growth of our thematic funds. These are funds that are led by regional experts who are deeply passionate about the ecosystem and are able to utilize 500 Startups to create scalable solutions in the particular region. One example is the 500 Durians family of funds in Southeast Asia. Headed up by Managing Partner, Khailee Ng, 500 Durians has raised 2 funds and made 190+ regional investments since 2014. Ng, given his entrepreneurial background and his passion for his home country of Malaysia and that region, has established the funds as an incredibly successful hub for founders in Southeast Asia.

We are proud of our bet on founders everywhere. Not only because it is a part of our mission to be bold and inclusive, but because of the incredible ecosystems that we have been able to foster and help grow.

NOTES:

THIS POST IS INTENDED SOLELY TO PROVIDE INFORMATION REGARDING 500 STARTUPS. ALL CONTENT PROVIDED IN THIS POST IS PROVIDED FOR GENERAL INFORMATIONAL OR EDUCATIONAL PURPOSES ONLY. 500 STARTUPS MAKES NO REPRESENTATIONS AS TO THE ACCURACY OR INFORMATION CONTAINED IN THIS POST AND WHILE 500 STARTUPS HAS TAKEN REASONABLE STEPS TO ENSURE THAT THE INFORMATION CONTAINED IN THIS POST IS ACCURATE AND UP-TO-DATE, NO LIABILITY CAN BE ACCEPTED FOR ANY ERROR OR OMISSIONS. THE INFORMATION PROVIDED ABOVE, INCLUDING INFORMATION REGARDING CURRENT AND HISTORICAL PORTFOLIO INVESTMENTS BY FUNDS ADVISED BY 500 STARTUPS IS NOT INTENDED AS A RECOMMENDATION TO PURCHASE, SELL OR HOLD ANY SECURITY OR THAT YOU PURSUE ANY INVESTMENT STYLE OR STRATEGY.

TOTAL COMMITTED CAPITAL IS APPROXIMATED AS OF JUNE 30, 2019 BASED ON INTERNAL DATA ACROSS THE ENTIRE FAMILY OF 500 STARTUPS FUNDS AND HAS NOT BEEN INDEPENDENTLY VERIFIED. UNLESS OTHERWISE STATED, THE FIGURES PROVIDED HEREIN ARE APPROXIMATED BASED ON INTERNAL ESTIMATES AS OF DECEMBER 1, 2019 AND HAVE NOT BEEN INDEPENDENTLY VERIFIED.

UNDER NO CIRCUMSTANCES SHOULD ANY INFORMATION OR CONTENT IN THIS POST, BE CONSIDERED AS AN OFFER TO SELL OR SOLICITATION OF INTEREST TO PURCHASE ANY SECURITIES. FURTHER, NO CONTENT OR INFORMATION CONTAINED IN THIS POST IS OR IS INTENDED AS AN OFFER TO PROVIDE ANY INVESTMENT ADVISORY SERVICE OR FINANCIAL ADVICE BY 500 STARTUPS. UNDER NO CIRCUMSTANCES SHOULD ANYTHING HEREIN BE CONSTRUED AS FUND MARKETING MATERIALS BY PROSPECTIVE INVESTORS CONSIDERING AN INVESTMENT INTO ANY 500 STARTUPS INVESTMENT FUND.